Category : Ecosystem Fund Allocation

Author : Campbell Law

Abstract

This document proposes a new $RARI rewards system for listing NFTs on Rarible and buying NFTs from Rarible aggregated NFT marketplace to incentivize users and capture value. It introduces the concept of RARI Rewards Collections that veRARI token holders will be able to vote on to identify NFT 5 collections eligible for $RARI rewards on a weekly basis, as well as 0% marketplace fees for stakers.

Motivation

By introducing a long-awaited update to the $RARI rewards system, we aim to establish a committed community of token holders and create a strong network effect that will increase engagement and attract new users to Rarible aggregated NFT marketplace.

This will be achieved by clear and concise mechanics for holders to lock their $RARI and receive veRARI that they can use to vote for collections to subsidize liquidity, and enjoy 0% trading fees on the marketplace. As a result, community members are expected to form a “sticky” behavior that will lead to recurring trades on Rarible.

Liquidity incentives include:

- Listing rewards paid to the lowest priced items with exponential decay.

- Purchase rewards paid proportionally to the volume of royalties paid, including purchases from other marketplaces, acting as royalties cashback.

This will create a vortex of liquidity moving from order books of carefully selected collections to Rarible Protocol’s order book.

Rationale

Whether the goods are digital or physical, marketplaces compete for two things to provide value to users: listings and sales. The more listings a marketplace has, the faster a buyer will find the item they seek. And the more buyers a marketplace attracts, the faster a seller can sell at the desired price.

This creates network effects, where each user provides positive externalities to every other user, which in turn attracts more users. For trading venue competition, this means the more liquidity a marketplace already has, the more liquidity it will likely attract in the future. As liquidity thus compounds, user experience improves: The more satisfying transactions a marketplace facilitates, the higher the likelihood that traders will return.

Neither additional features nor desirable branding compensate for lower liquidity. This is why both web2 and web3 marketplaces subsidize network effects to attract users to their platform.

$RARI started as a governance token with liquidity incentives directly incentivizing trading volume. The program succeeded in increasing volume, but at the cost of incentivizing wash trading and lacking long-run value capture. The community voted to end the program in January 2022.

The proposed token incentives for listing and buying on Rarible and Rarible Protocol-powered community marketplaces let us attract liquidity and kickstart the virtuous cycle outlined above in a sustainable way.

The proposed comprehensive update to $RARI tokenomics introduces:

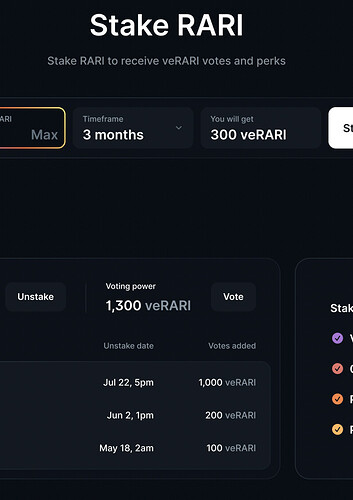

- $RARI staking for power to vote for collections to receive liquidity

- Listing rewards for Rarible Protocol orderbook

- Buying rewards for aggregated orders: royalties cashback

- RARI Prime benefits program

Voting

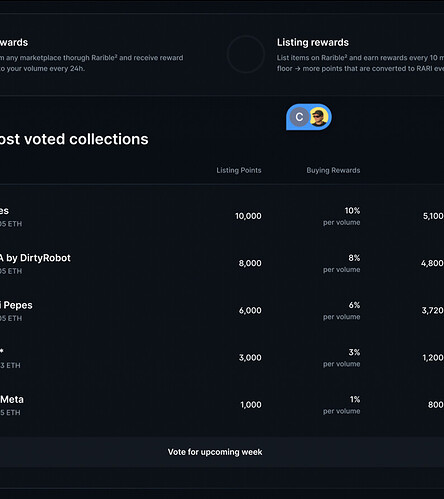

To avoid spreading incentives thin (e.g. incentivizing all collections at once), we propose to concentrate the liquidity incentives among a few collections selected by the community. To make the choice mechanism fair, we introduce a Weekly leaderboard selected by veRARI holders. By rotating collections that receive liquidity incentives, veRARI holders can make sure hot collections are incentivized for a specific period of time, but after that native/non-incentivized behavior is kept.

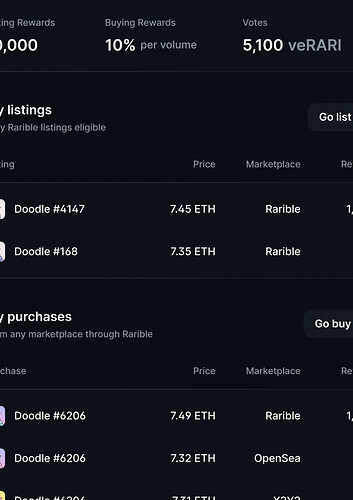

Listing rewards

To create a healthy marketplace, we aim to incentivize listings (sell orders) as close to the fair market value as possible. We will start by choosing 5 collections for liquidity incentives and implement the following model inspired by bonding curves:

The lowest priced listing with a price below 1.4X of floor inside a collection receives the highest reward with an exponential decay. The longer an item remains listed, the more value it provides to deter holders from listing items for mere seconds before delisting.

Buying rewards: royalties cashback

To process more transactions, we need both sides of the market. That’s why we want to encourage buyers by offering them rewards as well. Rarible Protocol’s access to orders aggregated from other marketplaces’ order books plays a key part here. Wherever the item is listed, if a user bought it through an aggregator, they can claim a reward.

It’s important to note that we expect a royalties cashback program will mainly be used to balance the supply/demand in the first weeks/months of the program, so over time rewards will be decreased.

Rari Prime: 0% Rarible orderbook fees and other perks

Rari Prime program is intended to be built on top of the new staking program. This mechanism creates value capture by providing fee discounts to preferred traders based on the time commitments. Thus it will help establish a core community incentivized to cast votes to subsidize liquidity to trade NFT collections which seem promising for the long term. As a basic rule we expect to make the orderbook fee 0% for power users that stake enough RARI

Key terms

veRARI – a non-standard ERC-20 implementation representing non-transferable voting power a holder receives upon locking their $RARI in a voting-escrow contract for a chosen period of time. Technically, veRARI is a non-standard ERC20 token implementation.

Lock – an instance of locked $RARI with a specific Release Schedule. One address can have multiple Locks with different Release Schedules. E.g. one may have a Lock of 100 $RARI with a one-month Release Schedule, and another Lock of 1000 $RARI with a two-year Release Schedule.

Epoch – predefined period of time equal to 1 week, during which Buying and Listing Rewards are applicable for 5 selected Collections.

Weekly voting leaderboard – weekly ranking of collections voted on by veRARI token holders, listed in the order according to the number of received votes.

Points – listing rewards accumulated by a user every 10 minutes according to the predefined formula. Points are converted into $RARI tokens at the end of every day.

Claiming – the process of receiving $RARI rewards from the claims contract. Rewards are not distributed automatically to a user’s wallet and need to be claimed.

RARI Prime – a status granted to $RARI stakers alongside with benefits including veRARI voting power, 0% marketplace fees, a special badge on Rarible marketplace, and private Discord access.

Specifications

We propose to allocate a total of 420,000 $RARI over the period of 1 month for these liquidity incentives

1 week - 30,000 $RARI/day

2-4 week - 10,000 $RARI/day

30,0007+10,0007*3 = 420,000

75% of daily reward to be spent on listing rewards (1 Week - 22,500 $RARI)

25% of daily reward to be spent on trading rewards. (1 Week - 7,500 $RARI)

Voting

A long-term committed community of $RARI holders will decide which collections should receive liquidity incentives. The top 5 collections ranked by number of votes for them at any time will receive liquidity incentives. To enable fair participation, a collection can’t receive liquidity incentives longer than 2 weeks out of every 4 weeks.

Terms:

There is a weekly Epoch cadence for elected collections. Votes are locked in every week at the same time (12 am UTC)

Every week veRARI holders can cast their vote to a specific collection that will be receiving $RARI rewards the following week

Vote is attached to a collection as long as the veRARI balance is kept.

Ex: I’m casting 100 veRARI for mfers

Vote can be changed until epoch lock-in and recast to another collection

Top 5 collections sorted by total sum of votes attached to them are deemed eligible for incentives.

A collection can’t receive more than 2 weeks of liquidity incentives during any 4 weeks time period.

The Rarible team reserves the right to vote for 1 Collection every week with the team’s tokens.

Rewards Lock

To avoid the inflation, we suggest the following distribution process:

20% of allocated rewards are to be released instantly to the users;

80% of allocated rewards are to be automatically staked for 1 month and gradually unlocked over the course of 4 Weeks.

The proposed process is aimed at incentivizing users to ongoingly collect rewards, shaping a sticky behavior.

Listing rewards

Terms:

Only listings in Rarible native orderbook under 1.4x of the floor price are eligible for the rewards

Every 10 minutes we take sorted listings by price low to high.

Starting from listing #1 to listing #100 according to the floor price each listing generates POINTS for every 10 minutes of existing according to the formula.

Points(N) = 900/N+100, where N is the listing number.

Now this might sound hard, but let’s see examples:

Listing #1 gets 1000 points every 10 minutes

Listing #2 gets 550 points every 10 minutes

Listing #3 gets 400 points every 10 minutes

Listing #4 gets 325 points every 10 minutes

Listing #5 gets 280 points every 10 minutes

Listing #6 gets 250 points every 10 minutes

…

Listing #20 gets 145 points every 10 minutes

…

Listing #50 gets 118 points every 10 minutes

Listing #100 gets 109 points every 10 minutes

If that’s a fresh listing, it should be live at least for 5 minutes before the first 10 minutes epoch to qualify for rewards. (Avoid bots listings just before the epoch and delisting seconds after)

Rewards are good while listing is active.

Every 24 hours points are converted into $RARI. Daily $RARI reward is equally distributed among all Points accumulated by users

$RARI can be claimed at a person’s discretion.

Buying rewards: royalties cashback

Terms:

The same list of top 5 eligible collections participates in the program.

Each user $dollar value of royalties is calculated.

Every 24 hours all royalties spent by all users are summed.

If that number is less than total amount of $RARI rewards allocated daily for Royalties Cashback (7,500 RARI for the first week)

In this case Reward = $royalties_paid

If total royalties paid more than daily rewards pool, this pool is split equally among all the buyers proportionally to royalties they paid.

In this case Reward = $royalties_paid/total_royalties * Daily_reward_pool

We expect royalties cashback to be a temporary program to later decay, and the Listing Rewards program to be prioritized.

Rari Prime

Requirements:

Own 20 veRARI from all your locks, which is an equivalent of 100 $RARI locked for 1 month.

Benefits:

0% Rarible marketplace & protocol fees (i.e. buy and sell on Rarible and Rarible Protocol-powered marketplaces for free)

Fee discounts schedule is expected to be actively governed to achieve protocol efficiency

Prime Status on Rarible Marketplace

Access to a gated Discord community

Steps to implement

Transfer to a separate wallet for Safe Contract controllable via veRARI (address: 0x04D4241c42B63706E4139b2C73a5661b7b4E6df9)

420,000 RARI for the program

Approve spending from Safe to Claims Contract