Hello everyone,

I’m opening this important discussion to highlight a pressing issue affecting our community: the severe lack of liquidity for the $RARI token on the Rari Chain.

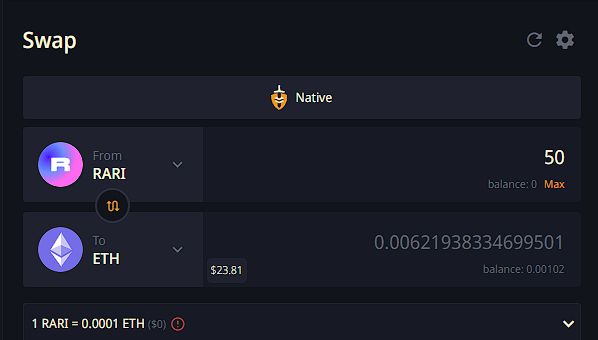

Currently, the only available liquidity pool for swapping $RARI on Rari Chain is on Camelot, with an extremely low TVL of approximately $150.

This results in massive price impacts even when swapping small amounts (e.g., swapping just $50 worth of $RARI leads to around a 50% price impact). Clearly, this is not sustainable and significantly diminishes the utility and attractiveness of participating on Rari Chain.

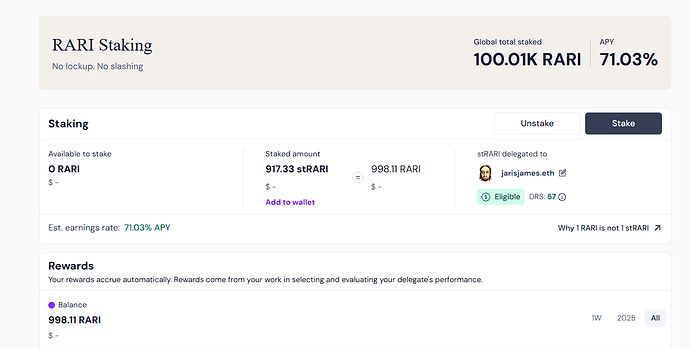

This issue has become particularly critical in light of the recent staking initiative. The staking program promotes “NO LOCKUP” periods, which is technically accurate.

However, due to liquidity constraints, users face a substantial indirect lockup if they choose to bridge their tokens back to ETH mainnet (the only location with sufficient liquidity). The only official bridge available via Arbitrum involves a waiting period of nearly 14 days, severely undermining the “no lockup” promise.

This situation poses a serious risk of discouraging both new and existing community members from staking or participating actively, limiting overall adoption and growth.

Previously, when I raised this issue with the RARI Foundation team last year, I was informed they were unable, for legal reasons, to allocate reserve funds directly to liquidity pools. Although no detailed explanation was provided, I respect their position and acknowledge the complexity around legal and compliance frameworks.

Given the Foundation’s constraints, I propose we, as a community and DAO, explore alternative solutions:

- Community-driven Liquidity Mining Program: Introducing modest incentives or liquidity mining rewards to encourage community members to provide liquidity on Camelot.

- Targeted Liquidity Boost: Even a relatively small allocation (between $10,000 to $50,000 USD) could substantially improve liquidity conditions, enhancing staking participation and attracting arbitrage traders who would further increase chain TVL and transaction fees.

I would love to gather your perspectives, insights, and additional ideas on this matter. Let’s collaborate to create a practical solution beneficial to all stakeholders. If there’s general support, we can follow up with a formal proposal.

Looking forward to your constructive thoughts and contributions.