Abstract

RARI governance is undergoing an upgrade via turning on protocol fees (RRC 28) and via the token upgrade (RRC 30). We believe turning on staking should be a third component of this governance upgrade.

We propose to unlock RARI utility and improve the governance and security of the RARI protocol by implementing RARI staking, without yet turning on fee distribution to token holders. Through RARI staking, token holders who delegate to active governance participants will be able to capture value. The proposal will also implement a liquid staked RARI token (stRARI) via the Tally Protocol that enables any future rewards to auto-compound, is (re)stakeable, and is compatible with DeFi. Separately, we will work with the RARI DAO to decide how to fund rewards and how to split rewards between token holders and delegates.

Motivation

Motivation to enable staking for RARI DAO is two-fold: (1) improve governance participation and (2) improve security of RARI DAO.

Enable staking to improve governance participation

RARI token utility is low and as a result, the RARI token is struggling to accrue value.

- Governance power is the only source of fundamental demand for RARI, while there are multiple sources of new supply (unlocks, treasury spending, etc.).

- The ability to restake RARI or use it on DeFi is not compatible with governance. Voting power breaks when RARI is deposited into smart contracts.

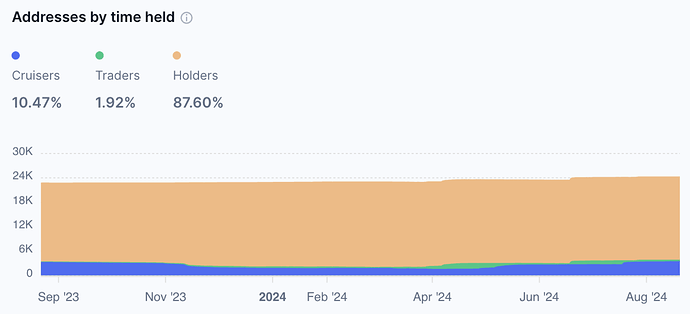

Right now, ~12.4% of RARI (that which does not belong to “Holders” on the below graph) is being used in the onchain ecosystem, meaning it cannot be used in governance. This robs the DAO of voting power that can be used to reach quorum and protect against malicious attacks.

From CoinMarketCap

The RARI token is struggling as a governance mechanism. The veRARI token model deterred participation because it adds complexity and commitment, discouraging those who may not want to lock up their tokens. Without staking, the DAO is also disallows RARI token holders that want to use these tokens in DeFi from voting.

With the recent move from veRARI to RARI for governance voting, RARI DAO is looking to incentivise active governance participation. Delegation has tripled since DAO launch in 2020, especially with the help of the Delegate Launchpad Proposal (RRC 9), but more tokens have not been used in voting.

Enable staking to improve security of RARI DAO

The strongest defense against attacks on a decentralized system is active governance participation and a broad, engaged delegate base. Staking plays a crucial role in achieving this by incentivizing users to commit their tokens and participate in governance. By turning on staking rewards and tying them to active participation in governance (via delegation to oneself or to someone else), the system can foster a more resilient and well-distributed decision-making process, which enhances overall security and stability within the DAO.

The RARI DAO treasury currently holds 4.67 million $RARI (worth over $7.19 million USD) from its initial allocation and will continue to generate revenue through the new fee structure. The DAO has the flexibility to decide how to use this revenue, with one suggestion being to allocate a portion for staking rewards. Separate from this current proposal, the DAO could consider setting aside a dedicated pool to enhance these rewards and incentivise early participation since staking rewards may be low initially.

As a result, it is becoming economically attractive for a malicious actor to launch a governance attack on the DAO treasury. The potential profit of attacking the DAO treasury is increasing as more RARI accumulates in the treasury, while the cost of attacking the DAO through purchasing RARI for its voting power is not increasing proportionally to defend against attacks. A more developed version of this dynamic exists in the ENS which is actively fighting off governance attacks (documented here) and in Compound, which fell victim to this type of attack recently (documented here). Had Compound enabled staking, which could have redistributed voting power to the DAO, it would not have been economically worth attacking the DAO because the increased cost of acquiring enough voting power through staking would have outweighed the potential rewards of the attack. Staking would have created a more robust defense by tying voting power to economic commitment, making it much more expensive and difficult for a malicious actor to gain control over governance decisions.

RARI Staking unlocks utility and aligns governance by creating a mechanism to stream future rewards from DAO-generated sources like protocol fees, token inflation, and treasury diversification to token holders who are delegated to an active governance participant. RARI Staking makes RARI usable in restaking and DeFi by returning voting power locked in contracts to the DAO.

Specifications and Steps to Implement

System architecture

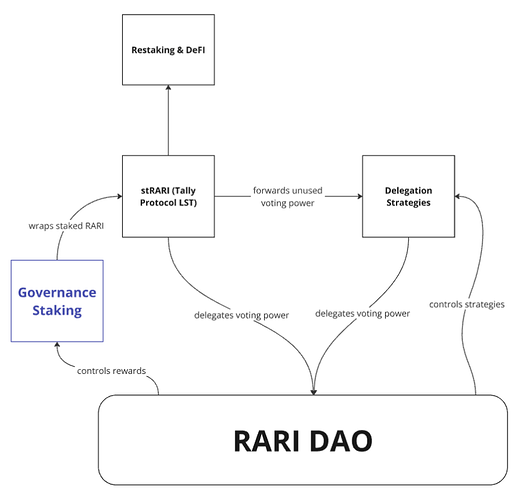

RARI Staking enables RARI utility while allowing the DAO to retain governance power. It includes a few modular components that come together to power the system.

RARI Staking via the Tally governance staking system

- Has the power to distribute fees proportionally to token holders who have delegated voting power to an active governance participant.

The DAO

- Has the power to turn on fee distribution and send fees to RARI Staking

- Controls how voting power is distributed to delegates, including delegation strategies for unused voting power

stRARI (Tally Protocol LST)

- Auto-compounds potential rewards if they are turned on in the future

- Provides token holders a liquid position

- Returns voting power to the DAO when stRARI is deposited into restaking, DeFi, and centralized exchanges. The RARI DAO exclusively has the ability to determine how this voting power is distributed/redelegated via a governance proposal. The DAO will decide how to set up the initial redelegation logic for stRARI.

Implementation details and eligibility for rewards

The Tally governance staking system builds on top of Unistaker. We will customize Unistaker for RARI’s governance architecture and fee collection mechanism. We will implement RARI Staking in such a way that it can accept arbitrary fee sources as rewards. We will also require that tokens be delegated to an active delegate.

We define an active delegate using Karma Score. The DAO will define the Karma Score requirement for being considered an active delegate. Karma Score is a combination of delegate’s Snapshot voting stats, onchain voting stats and their forum activity. To accurately calculate forum activity score, delegates are required to prove ownership of their forum handle by signing a message with their delegate address and posting on the forum. The current Karma score formula is below, which can be adjusted by the DAO going forward:

((100) * ((Forum Activity Score * 1) + (Off-chain Votes % * 3) + (Onchain Votes % * 5))) / (Sum of Weights times Max Score Setting * 1)

Karma Score will be included in RARI staking via a smart contract that writes data onchain from the Karma API. We will include several guardrails to ensure that this aspect of the implementation is robust and decentralized:

- Users can verify Karma score calculations independently.

- The DAO will have the ability to block Karma Scores if it believes they are being calculated incorrectly.

- If Karma scores fail to arrive or the scores are blocked by the DAO, RARI Staking will distribute rewards to all stakers regardless of whether they are delegated to an active governance participant until the situation is resolved.

In the future, we believe it would make sense to integrate delegate incentives with RARI staking so that, instead of getting delegate incentive funds from the RARI treasury, they come directly from onchain revenue.

Tally will build RARI staking into our existing RARI DAO platform, so that users can easily stake and delegate in one place.

Estimated Timeline

- Post proposal on forum for feedback: early September

- Post onchain proposal on Tally for funding: mid September

- Begin development: end of September

- Submit onchain proposal on Tally including full RARI Staking implementation: October

Cost

$100,000 USD in RARI of funding to cover the costs of development, including the following funding categories:

- $50,000 USD in RARI: Develop RARI Staking smart contracts

- Implement staking contracts

- Integrate RARI’s current and potential fee mechanisms

- Integrate Karma Score requirement

- Enable the DAO to block Karma Scores if it believes they are being calculated incorrectly

- $20,000 USD in RARI: Integrate RARI Staking into Tally.xyz

- $30,000 USD in RARI: Integrate Karma into RARI Staking

- Develop and deploy a smart contract to store key stats and Karma scores onchain

- Create a system to record stats onchain and store detailed delegate data off-chain (using Arweave or IPFS) for easy verification

- Continuously improve scoring algorithms to adapt to evolving RARI community needs

- Provide technical support to delegates experiencing issues with their statistics

- This is inclusive of a Karma integration valued at 15,000 USD/year

Separate to this proposal, we will submit an onchain proposal with the full RARI Staking implementation at the conclusion of the development process. In this onchain proposal, we will include a transfer of funds. No money needs to be paid before the work is complete.

Disclaimer

This proposal should not be relied on as legal, tax, or investment advice. Any projections included here are based on our best estimates and presented for informational purposes only.