Background & Context

The Rari DAO is in the middle of a major migration from the Ethereum mainnet (where RARI governance operates through veRARI lockers) to an Arbitrum-based L3 (Rari Chain). This shift was authorised by the DAO through RRC-30 and aims to improve governance efficiency, reduce gas costs, and give the protocol room to scale.

To migrate, veRARI holders must unstake, bridge, and delegate their tokens on Rari Chain. Without sufficient incentives, many users might hesitate to make this transition, so the DAO approved a one-year staking programme that offers rewards to stakers who delegate their voting power.

The programme is designed not only to facilitate migration from mainnet but also to attract new participants and strengthen overall governance engagement on Rari Chain. The programme’s overarching goal is to attract roughly 300 000 RARI (matching the amount locked in the veRARI contract) to the new staking contract. Staking incentives are therefore both a technical necessity for migration and a way to boost governance participation and token utility.

Executive Summary

-

Context. The Rari DAO is migrating governance from the Ethereum mainnet (veRARI) to the Rari Chain (stRARI). To bootstrap adoption of the chain and align token holders with delegates, the community approved a twelve-month incentives programme in April 2025. The proposal allocated 60,000 $RARI from the treasury to fund staking rewards and bridging quests. The goal was to attract approximately 300,000 $RARI to the new governance contract and offer a target APR of 25 %, 15 % and 10 % across three four-month phases.

-

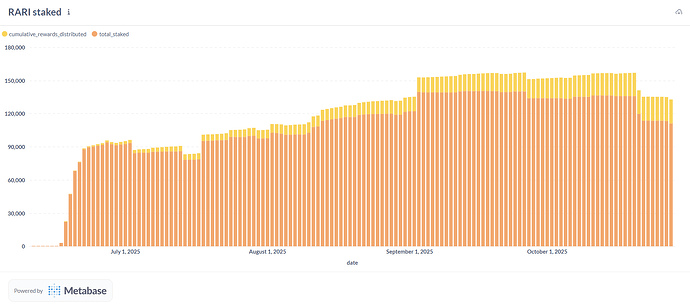

Overall TVL & rewards. Using on-chain data from the public Metabase card (RARI staked), we analysed daily total staked and cumulative rewards from 11 Jun 2025 to 18 Oct 2025. During this extended period:

- Peak TVL was ≈140 494 RARI (30 Aug 2025). Average TVL was ≈105 000 RARI with 135 831 RARI staked at the end (18 Oct 2025). This represents ~45 % of the 300 000 RARI target.

- 20 800 RARI in rewards were distributed, implying a cost per staked RARI of ~0.197 (≈19.7 % return over the 4-month period, equivalent to ≈56 % annualised APR).

- The realised APR (annualised rewards ÷ average TVL) is ≈56 %, more than double the Phase 1 target of 25 %.

-

Flows. Net inflows totalled ≈ 169,000 RARI, while outflows summed ≈ 34,000 RARI, indicating that most stakers remained throughout the period. Inflows spiked in June and early July as the programme launched and then stabilised after mid-September.

-

Insights. Early oversubscription pushed realised APR well above the target. In Phase 1, 20,800 RARI were distributed — ≈ 83 % of the 25,000 RARI Phase 1 allocation (≈ 42 % of the annual 50,000 RARI budget) — leaving ≈ 4,200 RARI unused within the phase.

-

A significant portion of the rewards went to a relatively stable base of stakers. Additional metrics (number of stakers, delegation behaviour, governance participation) are needed to evaluate alignment between staking and governance engagement.

Methodology & Data

-

Data source. Daily on‑chain totals were exported from the “RARI staked” public card on Tally’s Metabase. The data set contains date, total_staked and cumulative_rewards_distributed fields from 11 Jun 2025 to 18 Oct 2025.

-

Calculations. We converted dates to UTC and computed:

-

Average TVL: mean of daily total_staked.

-

Peak TVL: maximum daily total_staked.

-

Rewards distributed: difference between final and initial cumulative_rewards_distributed.

-

Realised APR: (total rewards ÷ average TVL) × (365 ÷ days).

-

Cost per RARI staked: total rewards ÷ average TVL.

-

Net inflows/outflows: sum of positive/negative daily changes in total_staked.

-

Weekly flows: aggregated inflows/outflows per ISO week.

-

-

Limitations: The dataset does not include number of wallets, individual stake sizes or governance participation. Without these metrics we cannot compute retention by cohort, Gini concentration or cost per delegate. Future reports should integrate additional on‑chain queries and wallet‑level data.

Key Results & Visualisations

Source: Metabase

Total staked over time

The total staked RARI grew rapidly in June, plateaued around mid-September, and reached ≈135 831 RARI by 18 Oct 2025, with a peak of ≈140 494 RARI in late August.

Cumulative rewards distributed

Rewards accrued linearly, reaching ≈20 800 RARI by 18 Oct 2025. This represents ≈83 % of the 25 000 RARI allocated for Phase 1, leaving ≈4 200 RARI unspent within the phase. Given that Phase 2 targets a lower APR (15 %), run-rate spending should decline, reducing the risk of overshooting the annual staking-rewards cap (50 000 RARI).

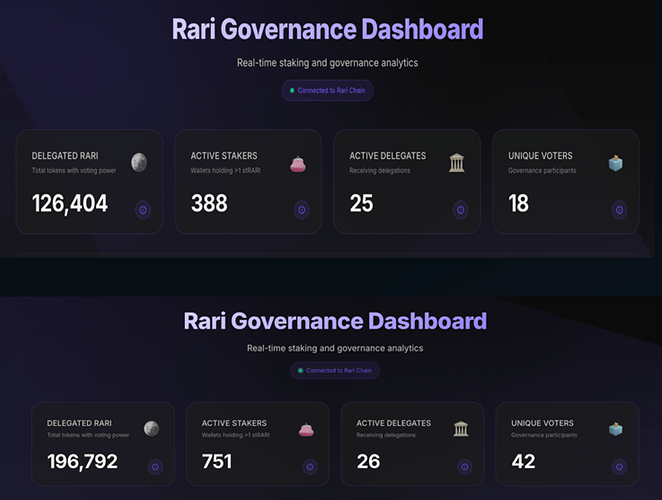

Governance metrics

At programme launch in mid-June 2025, governance activity on Rari Chain was near zero as staking and delegation contracts had just been deployed. By early July, the Rari Governance Dashboard reported 126,404 delegated RARI, 388 active stakers, 25 active delegates, and 18 unique voters.

By the end of Phase 1, these figures had increased to 196,792 delegated RARI, 751 active stakers, 26 active delegates, and 42 unique voters. This represents roughly a 56 % increase in delegated tokens, a 94 % growth in active stakers, and more than double the number of unique voters, while the number of active delegates remained stable.

These results confirm that the staking programme significantly improved on-chain participation and community engagement, though governance power remains concentrated among a few delegates, an aspect that requires continued monitoring in subsequent phases.

Weekly inflows and outflows

Weekly inflows were concentrated in the first four weeks of the programme (mid‑June to early July), accounting for most of the 169 k RARI of net inflows. Outflows remained modest (≈34 k RARI), suggesting strong retention.

KPI Summary

| Metric | Value | Notes |

|---|---|---|

| Duration analysed | 11 Jun 2025 – 18 Oct 2025 (130 days) | Extended data cut as of report date |

| Initial TVL | ≈2 RARI | Programme started from near-zero stake |

| Final TVL | ≈135 831 RARI | ~45 % of 300k goal |

| Average TVL | ≈105 000 RARI | Mean daily stake |

| Peak TVL | ≈140 494 RARI | 30 Aug 2025 |

| Rewards distributed | 20 800 RARI | 42 % of 50k annual budget |

| Realised APR | ≈56 % | Annualised return vs. 25 % target |

| Cost per staked RARI | ≈0.197 RARI | Rewards ÷ average TVL |

| Total inflow | ≈169 000 RARI | Sum of positive daily changes |

| Total outflow | ≈34 000 RARI | Sum of negative daily changes |

| Rewards per net inflow (spent/inflow) | ≈0.153 | 20 800 ÷ 135 000 ≈ 0.153 |

| Net inflow per reward | ≈6.5 RARI | Each RARI of incentives attracted ≈6.5 RARI of deposits |

- Overshooting targeted APR. The realised APR (~56 %) far exceeds the Phase 1 target of 25 %. This is because ~105 k RARI were staked on average—about one-third of the anticipated 300 k. Since rewards were fixed (25 k RARI over four months), fewer stakers meant higher per-wallet returns. If participation remains below the target, the programme will be more expensive per RARI than expected and the budget could deplete early.

- Strong initial growth then plateau. Inflows were front-loaded in June as holders bridged and staked. After early August the TVL stabilised around 130–140 k RARI and incremental inflows slowed. This suggests that the initial marketing push was effective but subsequent momentum waned.

- Retention appears high. Outflows (~34 k) were small relative to total inflows (~169 k), indicating most participants kept their stake through the initial 4-month phase.

- Partial progress towards 300 k target. By 18 Oct 2025 only ~45 % of the desired 300 k RARI were staked. Additional incentives or marketing may be needed to attract the remaining veRARI holders.

- Budget utilisation. As of 18 Oct 2025, 20 800 RARI have been distributed, leaving ≈29 200 RARI out of the 50 000-RARI annual staking budget (≈58 % remaining). Recalibrating to the Phase 2 target APR of 15 %—rather than 25 %—implies an estimated ~95 RARI/day in emissions, yielding ~307 days of runway (29 200 ÷ 95 ≈ 307), i.e., through ~21 Aug 2026 from 18 Oct 2025. This comfortably covers the remainder of the 12-month programme, contingent on comparable staked base and participation.

Strategic Considerations

- Dynamic reward schedule. Instead of fixed rewards, adopt a dynamic rate (e.g., percentage of average TVL) or a decaying function to align incentives with participation and avoid unexpectedly high APRs.

- Link rewards to governance participation. A governance participation pool is already set; the next step would be to adjust its parameters — either increasing its allocation or reducing rewards for passive stakers — to ensure incentives drive active voting and delegation rather than mere staking.

- Cap per-wallet rewards or use quadratic weighting. To mitigate concentration, introduce caps or diminishing returns for very large stakes, and provide higher effective yields for small/medium holders.

- Enhance analytics. Collect wallet-level data (number of stakers, stake distribution, delegate addresses) and governance metrics (turnout, proposal participation) to measure alignment with KPIs.

- Communications strategy. Continue targeted outreach to veRARI holders who have not yet migrated, emphasising improved yields and governance impact. Provide clear guides on bridging, staking and delegation.

Limitations

- Incomplete metrics. The dataset analysed only includes aggregated staked amount and cumulative rewards. It lacks wallet‑level metrics, price or liquidity data for stRARI, or governance participation statistics. Consequently, analyses of distribution (Gini), delegate activity or cost per active voter could not be performed.

- Short observation window. Data covers the first four months of a twelve‑month programme. Later phases may show different dynamics and APRs (15 % and 10 %) as budgets decrease.

- Off‑chain factors. Market events (RARI price volatility, competing yields) and marketing efforts also influence staking behaviour but were not assessed.

Appendices

Resources

Resources

Governance Proposals (Tally)

RRC-30 – Enhancing RARI DAO Governance (migration to Rari Chain)

RRC-34 – Enable RARI Staking (deployment of staking contract)

RRC-43 – RARI Staking Incentives Program (12-month incentives program, approved 16 May 2025)

RRC-45 – Fund Phase 1 of RARI Staking Rewards (authorises up to 25 000 RARI for Phase 1)

Analytics