Thanks for all the comments and replies! If you cannot edit the original post, can you please post the final proposal as a comment to your original post? In this way it appears here as a reply and people can see how the final version looks like before going onchain.

Great suggestion @Jose_StableLab ! I’ll share the fully reworked and edited proposal later today to ensure it’s ready for discussion during the next community call.

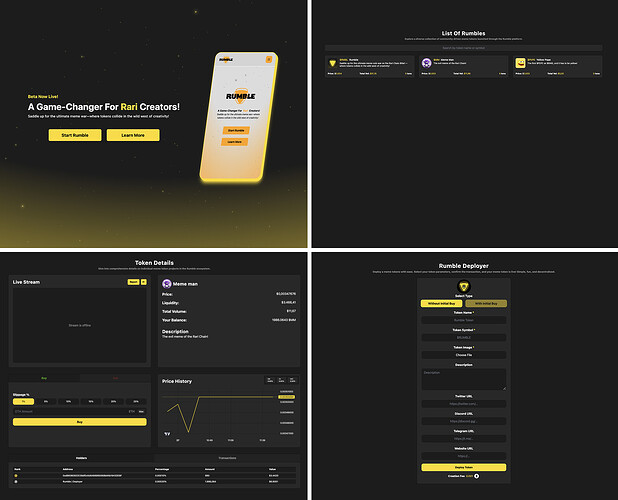

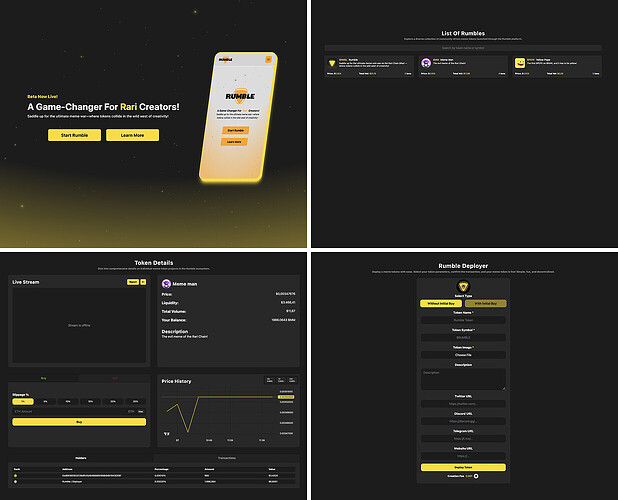

The Final Rumble.exchange DAO Support Proposal

Executive Summary

Rumble.exchange, the first meme coin-focused DeFi platform on Rari, is seeking support from the DAO to scale our innovative trading platform. We are requesting 10,000 $Rari tokens to fund platform development, maintenance, and marketing initiatives.

Introduction

Rumble.exchange is pioneering meme coin trading in the $Rari ecosystem through our unique standalone DEX with bonding curve mechanics. As the first DeFi application focusing on meme coins on Rari, we’re creating a new niche that combines trading excitement with ecosystem security.

Our core team consists of two dedicated members:

- Sidney (Founder): Leads back-end development, fine-tunes front-end functionality, and manages marketing and business development initiatives

- Derek (Co-founder): Specializes in front-end development while supporting back-end operations as needed

Current Status

- Successfully launched and operating platform

- Self-funded development and maintenance

- First-mover advantage in the Rari meme coin space

- Operating costs currently covered by founding team

Funding Request and Distribution (3 Phases)

We are requesting a total of 10,000 $RARI tokens, distributed across three milestone-based phases:

Phase 1: Initial Release (5,000 $RARI - 50%, upfront)

- Platform Development (40% allocation)

- Enhanced trading features

- User interface improvements

- NFT functionality to launch (meme) NFTs on a bonding curve

- Infrastructure and Maintenance (30% allocation)

- Server costs

- Ongoing technical maintenance

- Security monitoring

- Marketing and Growth (30% allocation)

- Community engagement initiatives

- Social media presence

- Educational content

Phase 2: 3-Month Milestone Release (2,500 $RARI - 25%, after 3 Months)

- Released upon meeting 3-month KPI targets

- Continues funding distribution across development, infrastructure, and marketing

Phase 3: 6-Month Milestone Release (2,500 $RARI - 25%, after 6 Months)

- Released upon meeting 6-month KPI targets

- Supports ongoing development and scaling initiatives

Marketing Strategy

Community Engagement

We’re initiating community growth through targeted activities:

- Twitter giveaways

- Trading competitions

- Regular AMAs

- Interactive community events

Content Marketing

- Comprehensive platform documentation

- Video tutorials and guides

- Regular social media updates

- Educational content focused on platform features

Organic Growth Strategy

- First-mover advantage in the Rari Chain ecosystem

- Feature rollout based on community feedback

- Focus on sustainable, organic growth

- Clear token listing process

- Emphasis on attracting genuine users over short-term fund hunters

- Strategic partnerships and community events

Key Performance Indicators (KPIs)

1. 1-Month Target

- Daily Active Users (DAU): 25+

- Monthly Trading Volume: $15,000+

- New Token Listings: 10+

- Community Growth: 1,000+ social media followers

2. 3-Month Targets

- Daily Active Users (DAU): 50+

- Monthly Trading Volume: $30,000+

- New Token Listings: 25+

- Community Growth: 2,500+ social media followers

3. 6-Month Targets

- Daily Active Users (DAU): 100+

- Monthly Trading Volume: $50,000+

- New Token Listings: 50+

- Community Growth: 5,000+ social media followers

Progress Reporting

We commit to providing:

- Monthly progress reports

- Transparent fund utilization updates

- Regular community AMAs

Value Proposition for the DAO

1. Ecosystem Growth

- Increased token utility for the $RARI ecosystem

- First meme coin focused DeFi platform

- Enhanced ecosystem diversity

2. Innovation

- Novel trading mechanics

- Unique bonding curve implementation

- New use cases for $Rari

Timeline

Implementation of proposed initiatives will begin immediately upon proposal approval, with first progress report delivered within 30 days.

Conclusion

As the first meme coin-focused DeFi platform on Rari, Rumble.exchange represents a unique opportunity to establish a new market segment within the Rari ecosystem. The requested funding will enable us to build a sustainable platform that contributes to Rari’s growth while maintaining security and user protection.

Documentation & Resources

For detailed information about Rumble’s features, mechanics, and usage:

Contact Information

Contact us

Discord Server

Enter Discord

Closing Note

Thank you to everyone in the community for your valuable feedback and honest opinions throughout this proposal process. Your input has been instrumental in shaping our proposal for Rumble.exchange. We’re excited about the potential to serve the Rari ecosystem and hope to welcome you all to the platform soon.

Let’s get ready to rumble! ![]()

It looks great! Thanks for integrating all the feedback. Let me know if you need help posting it for onchain voting.

Of course! Once again, thank you (and everyone else) for the valuable feedback that has helped improve the proposal.

Regarding the on-chain voting aspect—yes, we could use some help with that. I’ll send you a DM so we can move it forward to tally.

I really like the idea and I believe that platforms like these are much needed on Rari Chain. Essentially, meme coins are the META for 2024 and most likely for 2025. Rumble has user-friendly and most importantly BEGINNER friendly UI/UX which will enable everyone to launch coins. Such option currently doesnt exist on Rari Chain.

My favourite parts are Streaming and Chatting features as well as Bonding Curve NFTs. I think they will enable powerful tool for artists to showcase their art development and results while engaging with the community.

Sidney showed good building skills and he’s been more than willing to adapt to our ‘needs’ and suggestions. Looking forward to seeing proposal on Tally and voting YES.

Best of luck! @Sidney

I support this proposal—it’s clear that @Sidney and @Derek has put significant effort into the protocol, and it’s great to see proactive contributors in the ecosystem. The budget and KPIs seem reasonable, and I’m glad to see Rari Chain being utilized. I hope Rumble succeeds and sets an example for future projects.

On another note, I recently heard a great piece of advice about marketing: focus on crypto enthusiasts during bear markets and aim for mass adoption in bull markets. Memecoins play a unique role in bridging the gap, and Rumble could be a great tool for that.

That said, I do have a couple of questions. First, on security: do projects associated with the DAO or Rari Chain follow any established protocols or audits? Ensuring user safety is crucial for long-term success. Second, regarding the KPIs, will there be a focus on user retention metrics alongside acquisition to ensure sustainable growth?

If there’s anything I can help with, feel free to reach out. Best of luck!

Hey there @KAF Thanks for your feedback and support for Rumble.

Security is our absolute top priority. We’re building this platform with the same care and attention I’d want if I were a user myself. As someone who’s been in the public eye and is deeply passionate about web3, trust and transparency are everything to me.

Speaking of transparency - Derek and I are completely doxxed, with all our personal socials fully linked and open for everyone to see. As someone who’s been on several TV shows in the Netherlands, my reputation means everything to me.

We’re not some anonymous team hiding in the shadows - we’ve got real identities, real connections, and way too much to lose to ever risk our names on anything less than a fully legitimate and trustworthy project. Building cool, innovative platforms that make a real difference isn’t just a goal - it’s a commitment we take seriously.

I love your insights about marketing strategies and crypto cycles. It’s exactly the kind of thoughtful approach we’re taking with Rumble. We’re not just creating another memecoin - we’re trying to build something with real purpose.

Your point about user retention is spot on. We’re not just looking to bring people in; we want to create an ecosystem where users see genuine, ongoing value.

We’re pumped about what we’re building on the Rari Chain and always open to hearing more ideas. Feel free to shoot over any thoughts you might have!

Ive met Sidney and Derek several times in Holland, the first time was at the music festival Ground Zero, they took good care of me there. We even went to the Avalanche summit in Argentina a couple of months ago. They are an ambitious and talented team of developers able to build a lot of applications.

I am very happy that they’ve decided to come to the Rari Chain and help build the future together. Its a great thing if you are able to work together on something with real life friends.

Looking forward to see the proposal go live on Tally and to see our beloved blockchain grow!

LFG

Thanks for amending the proposal @Sidney!

Whilst I appreciate the value add of Rumble to RARI Chain and it filling an ecosystem gap, one thing I feel hasn’t been covered here is how you will work with other RARI Chain ecosystem dapps and the ultimate benefit of you receiving $RARI for things like co-marketing.

Throughout our DeFi campaign, we’ve seen daily transactions grow up to 40x any have tens of thousands of new users who have explored the ecosystem, jumping between each of the ecosystem dapps e.g. Stargate, Camelot, Nucleus, Rarible etc.

How will you work with other dapps? I am concerned that Rumble acting as a standalone platform will limit its success within our ecosystem (for example once tokens have bonded, why aren’t liquidity pools then created on Camelot?). Also, without factoring in the wider user journey on RARI Chain into your plans, how can you help drive more RARI Chain usage (with Rumble as an entry point) when most other chain ecosystems also have memecoin launchpads?

Essentially, what I’m saying here is I don’t feel your current launch approach is comprehensive enough. Can you share more on previous platform launches in other ecosystems and how support from them financially benefited your dapps and resulted in stronger marketing campaigns? How are you driving users towards Rumble already?

Many thanks! ![]()

Hi Sidney,

I’m jumping in here to voice a concern around the proposal and the overall ecosystem benefit. I know we’ve been chatting around the RARI Foundation supporting Rumble with co-marketing, and a concern that I have raised continuously is you not getting a paid audit for the Rumble code. I also noticed that you didn’t directly address this in your response to @KAF which is a little unsettling.

In my personal view, this is fundamental for any community to trust builders of dapps they use and is an external stamp of approval that any given Web3 platform is reputable. This is absolutely the industry standard and all other dapps within the RARI Chain ecosystem, especially ones we support with co-marketing, have received audits from reputable firms and published findings publicly.

Please could you address my concern here?

Hi @imastephen

Thank you for your thoughtful feedback. Let me address your concerns about ecosystem integration and provide more clarity about our approach.

You raise an excellent point about ecosystem integration. The reality is that building Rumble has already required significant development resources, and we want to be transparent about our, step-by-step approach to growth. While we have ambitious plans for Rumble’s future (as hinted at by our .exchange domain (I’ve told you about this in our previous call)), we believe in validating each phase thoroughly before committing to next steps.

Our bonding curve mechanism is currently designed to create sustainable liquidity and strong price discovery - it’s a complex system that we’ve put considerable thought into, so that means that the bonding curve will practually won’t bond. There is no display that shows a bonding process, it simply shows the price for what people can buy or sell tokens.

Regarding future development, we’re exploring various options for when tokens mature beyond the initial bonding curve phase. However, we want to be measured about making specific commitments until we’ve proven our core model and grown our user base.

Regarding the audit concern - our current smart contract is intentionally small and focused, handling only the bonding curve mechanics within Rumble’s controlled environment. While we absolutely plan to obtain a comprehensive audit from a reputable firm before expanding to broader trading functionality, we’ve prioritized a lean and secure initial implementation. Once we move to our next phase - whether that involves our own DEX capabilities or other (Camelot) integrations - we’ll pursue a full audit.

The requested funding would help us accelerate our development timeline while maintaining high quality standards. We want to build something truly valuable for the ecosystem, which means taking the time to do it right rather than rushing to implement everything at once.

One important point I’d like to emphasize is our intention to actively collaborate with quality (meme) tokens that launch on Rumble. While we’ll implement a double-check procedures about these tokens before collaborating. We’re committed to working closely with legitimate projects to help them succeed and grow (both) within the ecosystem.

We see Rumble serving as a unique entry point for the meme coin enthusiasts who might not otherwise explore the RARI ecosystem. We’re very open to exploring integrations and collaborations with other ecosystem dapps that make sense for our users, our platform, and the broader RARI community.

I’m happy to discuss potential ecosystem collaborations that you might had in more detail by a call? Derek and I are interested in finding ways to create mutual value while staying true to our core vision and development principles.

Hey, thanks for putting together this proposal—it’s clear you’ve put a lot of thought into it, and I appreciate the effort. That said, I’ve got a few concerns and questions that I think are worth addressing before I can fully get behind this.

First off, the whole virtual liquidity thing is interesting, and I get the appeal—it makes trading easier without requiring people to jump in and provide liquidity upfront. But my main concern is what happens long-term. How do you transition from virtual liquidity to actual liquidity? Like, at some point, someone has to provide the real backing, right? What’s the plan for that? And what happens if trading volume scales faster than expected? These feel like important questions that need more clarity.

Now, on the bonding curve. I’m not totally sold here. It’s a cool idea in theory, but I’m worried about how it actually plays out in practice. Stuff like front-running, price manipulation, or just extreme volatility—how do you handle that? Also, the explanation is a little light on details. For example, how’s the curve actually set up? How do you keep it stable during big buys or sells? A bit more transparency on this would go a long way, especially if you’ve got test results or simulations to show how it works under stress.

And then there’s the security piece. Look, I get wanting to roll out fast, but launching without an audit? That’s risky. Even a small, focused contract can have vulnerabilities. I’d feel a lot better if there were at least a preliminary audit before launch—it just feels like a must when you’re dealing with people’s money.

Lastly, I think the proposal could use a stronger section on risk management overall. Things like market manipulation, scalability, and user expectations around virtual liquidity—these are the kinds of risks that can make or break a project. I’d love to see a dedicated section outlining how you’re planning to handle these and what safeguards you’re putting in place.

Don’t get me wrong—I think there’s some real potential here, but these are the areas I think need more attention. Looking forward to seeing how you address these points and refine the proposal!

Thank you for taking the time to engage with our forum post and sharing your thoughts. I appreciate the effort you put into your feedback and this gives me the opportunity to clarify some points about Rumble, its mechanics, and its vision.

1. Virtual Liquidity and Its Purpose

Virtual liquidity is a fundamental requirement for platforms like Rumble, and it’s not unique to our project. Platforms such as Pump.fun (Solana), Degen Express (Sonix), Ignite (AVAX), and Uptos.pump all utilize virtual liquidity for good reason.

The primary purpose of virtual liquidity is to set a price for a token upon creation without requiring the user to provide their own liquidity. This model solves a key problem in traditional token launches, where users either had to:

- Conduct a presale or fund the liquidity pool themselves, or

- Face the risk of creators pulling liquidity after launch (i.e., rug pulls).

With virtual liquidity, Rumble ensures that token creators can launch their tokens easily and securely while avoiding the risks associated with liquidity management. It’s important to note that virtual liquidity doesn’t lock users into eventually providing their own liquidity—it simply establishes the token’s price mechanism at launch.

I hope this clears up your question about the role and necessity of virtual liquidity in platforms like Rumble.

2. Scalability and Transaction Volume

Regarding your concerns about scaling, the platform is designed to handle price adjustments per transaction. Every buy increases the price, and every sell decreases it—this is independent of the overall trading volume.

If your question refers to high-frequency transactions (e.g., multiple users transacting simultaneously), it’s worth noting that failed transactions can happen during periods of intense volume. This isn’t unique to Rumble; it’s common across decentralized platforms. The solution here is slippage settings, which we’ve integrated into Rumble.

Slippage ensures that transactions go through even in high-volume conditions, although users might receive slightly fewer tokens depending on the percentage set. This is a standard feature of any Automated Market Maker (AMM) and helps mitigate failed transactions during periods of high activity.

3. Bonding Curve Dynamics

Bonding curves are not new—they’ve been used long before crypto and are a well-established pricing mechanism. As a quick refresher:

- A bonding curve defines the relationship between price and supply.

- There are several types, such as linear, exponential, and logarithmic curves, among others.

Rumble uses an exponential bonding curve, which means the price increases at an accelerating rate as tokens are bought. Each sell reduces the price accordingly.

Some concerns around bonding curves stem from misunderstandings of their mechanics. In Rumble’s case, the bonding curve ensures predictable price movement tied directly to user activity. While slippage and timing may lead to some users securing better prices than others, this is inherent to decentralized trading and not unique to bonding curves. It’s also worth noting that no system can eliminate bots or ensure perfect timing fairness, though we have measures in place to minimize manipulation.

4. Security and Auditing

You raised a valid concern about security and audits, so let me explain our approach. Rumble, like Pump.fun and other similar platforms, is intentionally not audited at this stage. Auditing the contract would require making it public, which creates opportunities for frontrunning, MEV bots, and other forms of exploitation. Keeping the contract private is a deliberate decision to safeguard users.

This approach may feel unconventional compared to utility-focused DeFi platforms, but Rumble is a meme token launchpad, and its risks align with its purpose. Users entering this space are aware of these risks, and we’re transparent about the platform’s experimental nature. As Rumble evolves, we’ll explore audits or security reviews when the timing and purpose align with our goals.

Final Thoughts

Rumble is built to embrace the fun, experimental, and risky nature of meme tokens. It’s not designed to compete with traditional utility token platforms or liquidity protocols—it’s a lightweight launchpad inspired by Pump.fun and tailored for meme trading.

Your feedback helps us improve our communication about Rumble’s features and purpose, and I’ll make sure the proposal reflects these clarifications. If you’d like to dive deeper into any of these topics or have more questions, feel free to reach out.

Thanks again for your input—it’s much appreciated!

RRC-36 Rumble.exchange - DAO Support Proposal - On-Chain Proposal

Abstract

Rumble.exchange, the first meme coin-focused DeFi platform on Rari Chain, is seeking 10,000 $RARI tokens to scale its platform. The funding will be milestone-based, supporting development, infrastructure, and marketing initiatives aimed at driving adoption, community engagement, and ecosystem growth.

Motivation

The Rari Chain ecosystem can benefit from the rising popularity of meme coin markets, which are proven drivers of community growth and user engagement. As the first meme coin-focused Launchpad on Rari Chain, Rumble.exchange creates a unique opportunity to establish a thriving niche and attract new users to the ecosystem.

Rationale

Supporting Rumble.exchange aligns with the Rari Foundation’s mission to foster decentralized innovation and community-led growth. By providing a platform for meme coin trading and NFT integration, Rumble.exchange increases the utility of $RARI while introducing novel use cases and strengthening ecosystem diversity.

Key Terms (optional)

- Bonding Curve Mechanics: A pricing mechanism where token prices dynamically adjust based on supply and demand.

- Launchpad/Dex: Decentralized Launchpad/Exchange enabling peer-to-peer trading without intermediaries.

Timeline

Implementation of proposed initiatives will begin immediately upon proposal approval, with first progress report delivered within 30 days.

Specifications

Platform Features

- Standalone Launchpad utilizing bonding curve mechanics for meme coin trading.

- Integration of NFT functionality for launching and trading meme NFTs.

- User-friendly front-end optimized for seamless trading experiences.

Technical Infrastructure

- Scalable back-end architecture with enhanced security and server management.

Marketing and Community Initiatives

- Twitter giveaways, trading competitions, and AMAs to grow the user base.

- Educational content, video tutorials, and platform documentation.

- Organic growth strategy focused on attracting genuine users and avoiding short-term reward farming.

Steps to Implement

To ensure transparency and accountability, Rumble.exchange will provide:

- Monthly progress reports on development, infrastructure, and marketing.

- Transparent updates on fund utilization and milestone achievements.

- Community AMAs to discuss progress, address feedback, and align on goals.

Phase 1: Initial Development and Launch (5,000 $RARI - 50%)

- Enhance trading features, improve UI/UX, and integrate meme NFT functionality.

- Cover infrastructure costs (server and maintenance).

- Launch marketing campaigns, including community engagement events.

Phase 2: 3-Month Milestone (2,500 $RARI - 25%)

- Release new features based on user feedback and KPIs.

- Expand marketing initiatives and user acquisition efforts.

- KPIs: 50+ Daily Active Users, $30,000 Monthly Trading Volume, and 2,500+ social media followers.

Phase 3: 6-Month Milestone (2,500 $RARI - 25%)

- Scale platform operations, security enhancements, and infrastructure upgrades.

- Host competitions and community-driven events to drive continued growth.

- KPIs: 100+ Daily Active Users, $50,000 Monthly Trading Volume, and 5,000+ social media followers.

Timeline

- Phase 1: Start immediately upon approval (1 month).

- Phase 2: Complete 3-month KPIs and milestone report.

- Phase 3: Complete 6-month KPIs and final milestone report.

Overall Cost

Total Requested: 10,000 $RARI

- Phase 1: 5,000 $RARI (50% upfront)

- Phase 2: 2,500 $RARI (25% at 3-month milestone)

- Phase 3: 2,500 $RARI (25% at 6-month milestone)

Multi-sig policies

- Assuming a 3-member squad, the multi-sig will be structured as 2 out of 3: ( @forexus , @Firefly808 , @Sidney )

- Multi-sig address: 0xa110922a5E981e1442f2D519373f94CCd74a4B93

- 50% of the total funding will be allocated upfront to Rumble, while the remaining 50% will be deposited into a multi-signature wallet. Funds in the wallet will only be released upon achieving specified milestones, with approval required from both @Firefly808 and @forexus .

You Can Vote Here

Thank you all for your valuable feedback and support, and a special thanks to @Jose_StableLab for publishing the proposal to the tally. Wishing everyone happy holidays and a fantastic new year ahead. Here’s to steady growth and great successes in 2025. let’s make it happen together!

Voted yes! Best of luck ![]()

I’m in full support of this proposal, and will vote for.

The educational content will be key for onboarding users that may be a bit out of the loop/hesitant to join the meme ecosystem (like myself), but still willing to learn and participate meaningfully.

Hi! It has been 3 months now since the execution of RRC - 36. To unlock the first tranche of the milestones you should issue a report stating the completion of the stated key metrics. Otherwise, those funds will be returned to the DAO.

Thanks for the response, @Jose_StableLab . Total agreement, it feels like this project has gone quiet. I would also like to see a status update with milestones completed.

Rumble Exchange: 3-Month Update and Decision to Pause Development

Introduction

Three months ago, on January 6th, 2025, the Rari DAO approved our proposal for Rumble Exchange, the first meme coin-focused DeFi platform on Rari Chain. As promised, we’re providing this 3-month update on our progress, challenges, and our difficult decision regarding the future of Rumble Exchange.

What We’ve Accomplished

Despite significant obstacles, we’ve worked diligently to deliver on our promises:

-

Platform Development:

- Implemented significant back-end optimizations to improve platform speed and performance

- Maintained server infrastructure with monthly costs to keep the platform operational

-

Community Efforts:

- Hosted voice chat sessions to attract users from our other projects, with virtually no interest

- Launched Twitter giveaway campaigns (create your own coin and win $100), which received no participation despite extending the deadline by a month

- Created a side project focused solely on NFTs to attract a different audience, with no success

- Attempted to make our other platform (Collaboard) multi-chain to funnel users to Rari and Rumble, again with no success

-

Additional Initiatives:

- Developed Rari Name Service (RNS), an ENS fork enabling users to send tokens to named addresses, which initially received positive feedback from the foundation but was met with silence after multiple follow-up attempts

- Created a custom RNG script to support NFT raffles, as Rari Chain lacks on-chain RNG functionality, though we had serious concerns about security

Fundamental Challenges

After three months of active development and community engagement, we’ve identified several critical issues that make continued development untenable:

-

Non-existent User Base: Despite multiple promotional efforts across different channels, we’ve seen virtually no user engagement. Our giveaways and competitions received zero participation, indicating a fundamental lack of users on the chain.

-

Inconsistent Standards: While we were repeatedly asked about audits for our contracts, we observed that other promoted projects on the chain (like Buzz Fun built on Abstract) also operate without audits or verified contracts, creating an uneven playing field.

-

Communication Breakdown: Communication with the Rari team has been extremely difficult and one-sided. Despite being available 24/7 on Discord and Twitter, our messages often go unanswered. Interactions with the DeFi project liaison have been particularly frustrating, with responses that felt dismissive rather than collaborative, creating an environment that feels like gatekeeping rather than ecosystem building.

-

Lack of Clear Direction: The foundation appears to have no clear strategy for DeFi growth or ecosystem development. Initial enthusiasm for our initiatives quickly faded without explanation, leaving us to navigate blindly without support.

-

Technical Limitations: The absence of critical infrastructure like on-chain RNG has forced us to create workarounds that we don’t consider secure enough for handling real financial transactions.

Our Decision

After careful consideration and three months of active development, we’ve made the difficult decision to pause further active development on Rumble Exchange. This means:

- The platform will remain online and fully functional

- All created, bought, or sold tokens will continue to be accessible

- Basic maintenance will be performed as needed

- We will not be accepting the funds for the upcoming milestones, which should remain in the DAO treasury

Why This Decision?

To be completely transparent: Rari Chain is simply not ready for DeFi platforms like Rumble Exchange. While the chain itself has technical merits (fast transactions and low gas fees), the ecosystem lacks the fundamental components needed for DeFi success:

- An active user base

- Clear direction from the foundation

- Consistent communication channels

- Technical infrastructure for secure DeFi applications

- Supportive environment for builders

As developers passionate about building useful products, we cannot justify continuing to invest time and resources into a platform with no users and inadequate ecosystem support. We’ve attempted numerous strategies to drive adoption, all without success. The current state of the Rari ecosystem does not provide the foundation needed for any DeFi project to thrive, regardless of quality or innovation.

Looking Forward

We remain open to reconsidering our decision should the Rari ecosystem experience significant changes in user adoption and foundation support. However, this would require fundamental shifts in how the ecosystem operates and supports its builders.

We appreciate the opportunity provided by the Rari DAO and wish the best for the future of the chain.

The Rumble Exchange Team