Thank you for taking the time to engage with our forum post and sharing your thoughts. I appreciate the effort you put into your feedback and this gives me the opportunity to clarify some points about Rumble, its mechanics, and its vision.

1. Virtual Liquidity and Its Purpose

Virtual liquidity is a fundamental requirement for platforms like Rumble, and it’s not unique to our project. Platforms such as Pump.fun (Solana), Degen Express (Sonix), Ignite (AVAX), and Uptos.pump all utilize virtual liquidity for good reason.

The primary purpose of virtual liquidity is to set a price for a token upon creation without requiring the user to provide their own liquidity. This model solves a key problem in traditional token launches, where users either had to:

- Conduct a presale or fund the liquidity pool themselves, or

- Face the risk of creators pulling liquidity after launch (i.e., rug pulls).

With virtual liquidity, Rumble ensures that token creators can launch their tokens easily and securely while avoiding the risks associated with liquidity management. It’s important to note that virtual liquidity doesn’t lock users into eventually providing their own liquidity—it simply establishes the token’s price mechanism at launch.

I hope this clears up your question about the role and necessity of virtual liquidity in platforms like Rumble.

2. Scalability and Transaction Volume

Regarding your concerns about scaling, the platform is designed to handle price adjustments per transaction. Every buy increases the price, and every sell decreases it—this is independent of the overall trading volume.

If your question refers to high-frequency transactions (e.g., multiple users transacting simultaneously), it’s worth noting that failed transactions can happen during periods of intense volume. This isn’t unique to Rumble; it’s common across decentralized platforms. The solution here is slippage settings, which we’ve integrated into Rumble.

Slippage ensures that transactions go through even in high-volume conditions, although users might receive slightly fewer tokens depending on the percentage set. This is a standard feature of any Automated Market Maker (AMM) and helps mitigate failed transactions during periods of high activity.

3. Bonding Curve Dynamics

Bonding curves are not new—they’ve been used long before crypto and are a well-established pricing mechanism. As a quick refresher:

- A bonding curve defines the relationship between price and supply.

- There are several types, such as linear, exponential, and logarithmic curves, among others.

Rumble uses an exponential bonding curve, which means the price increases at an accelerating rate as tokens are bought. Each sell reduces the price accordingly.

Some concerns around bonding curves stem from misunderstandings of their mechanics. In Rumble’s case, the bonding curve ensures predictable price movement tied directly to user activity. While slippage and timing may lead to some users securing better prices than others, this is inherent to decentralized trading and not unique to bonding curves. It’s also worth noting that no system can eliminate bots or ensure perfect timing fairness, though we have measures in place to minimize manipulation.

4. Security and Auditing

You raised a valid concern about security and audits, so let me explain our approach. Rumble, like Pump.fun and other similar platforms, is intentionally not audited at this stage. Auditing the contract would require making it public, which creates opportunities for frontrunning, MEV bots, and other forms of exploitation. Keeping the contract private is a deliberate decision to safeguard users.

This approach may feel unconventional compared to utility-focused DeFi platforms, but Rumble is a meme token launchpad, and its risks align with its purpose. Users entering this space are aware of these risks, and we’re transparent about the platform’s experimental nature. As Rumble evolves, we’ll explore audits or security reviews when the timing and purpose align with our goals.

Final Thoughts

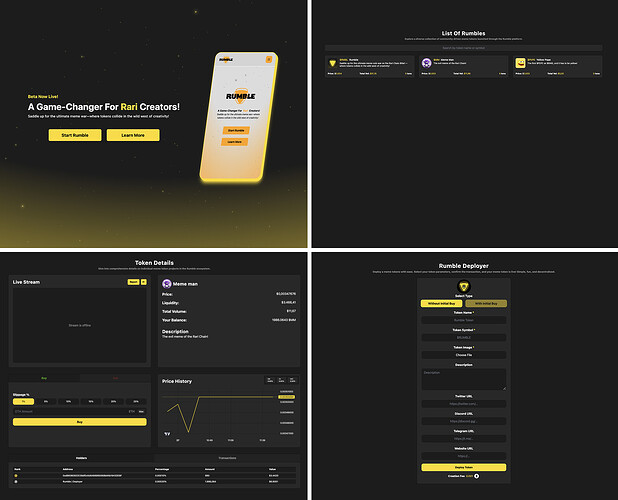

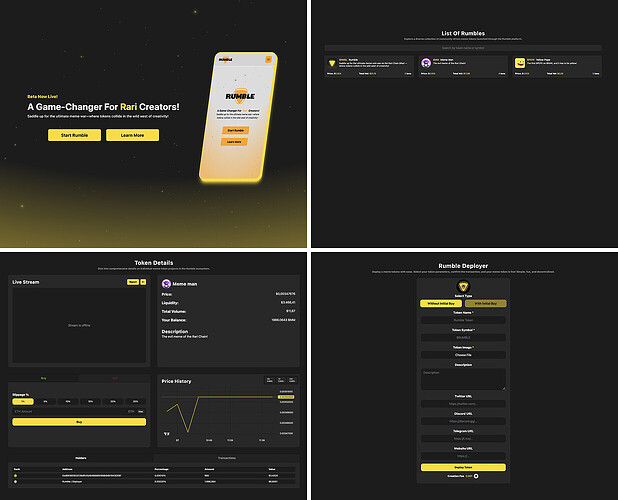

Rumble is built to embrace the fun, experimental, and risky nature of meme tokens. It’s not designed to compete with traditional utility token platforms or liquidity protocols—it’s a lightweight launchpad inspired by Pump.fun and tailored for meme trading.

Your feedback helps us improve our communication about Rumble’s features and purpose, and I’ll make sure the proposal reflects these clarifications. If you’d like to dive deeper into any of these topics or have more questions, feel free to reach out.

Thanks again for your input—it’s much appreciated!

![]() This is a must-watch for anyone looking to dive into the wild west of memes and explore our unique, and the first meme launchpad on the Rari Chain.

This is a must-watch for anyone looking to dive into the wild west of memes and explore our unique, and the first meme launchpad on the Rari Chain.