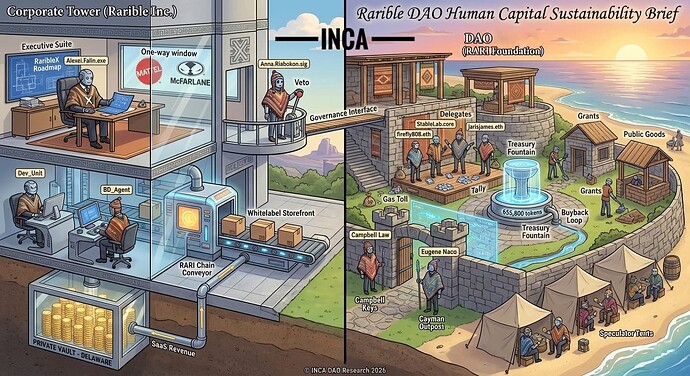

Two structures share one name. The RARI Foundation, a Cayman entity directed by Campbell Law and technically lead by Eugene Nacu, holds protocol keys and a 2.6% token supply in treasury. Rarible Inc., a Delaware C-Corp, holds venture capital and signs payroll. This legal barrier separates equity value from token volatility.

Alexei Falin and Alexander Salnikov, founders originating from Moscow, built the core IP. Anna Riabokon now operates at the governance interface. Jonathan Colon secures enterprise partnerships. A centralized team controls the operational reality.

The human capital forms distinct tiers. Undisclosed employees with equity and benefits build RaribleX, the white-label platform serving clients like Mattel and McFarlane Toys. An extended workforce of 50 contributors sustains governance. The Delegate Incentive Program allocates a pool of RARI tokens quarterly among 8-12 top delegates, representing a $100/week wage compensation for full-time governance work.

Revenue flows to the corporation. Enterprise licensing deals with major brands generate direct fiat payments. The DAO treasury receives a minor pass-through grants. The RARI token itself holds no appreciation or direct claim to the income.

Governance displays a curated democracy. 44 delegates vote via Tally. A 5-member Security Council, including Campbell Law, Eugene Nacu, Andrei Taraschuck, Mattew Stein (StableLab), Jafett Sandi, holds ultimate upgrade keys and proposal filtering authority. Token distribution is fragmented; the largest holder controls 27% while top 10 holds beyond 62% of supply. Nevertheless, 2000 tokens grants voting weight, but no path to override the Council’s veto.

The RARI Chain, an Arbitrum Orbit L3, functions as a defensive moat. The node-level royalty enforcement protects the business model for enterprise clients. However, the current infrastructure could be restructured as a primary liquidity venue to expand the onchain permissionless ecosystem.

Notably, the DAO is sustained by speculative labor subsidizing enterprise software development. The token market cap floats separately from the 15.95 million dollars in venture equity. Value is created here and captured there, separated by a Cayman firewall for corporate consolidation.

© INCA DAO Research 2026. Reproduction is reserved for formal licensing engagements.