Dear Rari DAO Community,

The Rari Foundation’s request for a $2.3 million operational budget for 2025 is not only unwarranted but a stark example of misaligned priorities and ineffective leadership. After a thorough review of the Foundation’s performance, financial practices, and overall impact, it is evident that approving such a budget without significant structural reform is an unsustainable and illogical decision. Here is a detailed analysis of why this proposal must be rejected and why immediate changes are necessary.

A Year of Failures and Mismanagement

Rari Chain Debacle:

The Rari Chain launch—intended to be a flagship initiative—was an unmitigated disaster. The Galaxe campaign, instead of building momentum, revealed the team’s lack of preparation. Users encountered fundamental issues such as:

- No functional DEX for basic token swaps (e.g., WETH to ETH), rendering the chain unusable for NFT transactions.

- A complete absence of compelling applications, tokens, or platforms to justify engagement.

The result? Within weeks, Rari Chain was abandoned. A launch of this magnitude required thorough planning and infrastructure, which were glaringly absent.

Galaxe Quest Mismanagement:

The Galaxe quest campaign not only lacked foundational support but was plagued by significant platform issues. Users faced countless bugs, with many unable to confirm quest completions. The situation worsened when sybil wallets flooded the leaderboard, farming points and displacing organic participants. Legitimate users quickly realized the futility of competing and abandoned the campaign entirely.

Moreover:

- NFTs minted during the quest plummeted to $0 floor price immediately after issuance. Organic participants lost money, while sybil attackers exploited the poorly designed system.

- The rewards structure was hastily devised, further alienating participants.

- Artists, handpicked by the Rari team in a centralized manner, benefited disproportionately, amassing hundreds of ETH while disregarding the community. These artists reaped significant profits without reinvesting in or contributing to the ecosystem.

This poorly executed campaign not only failed to attract long-term users but actively drove them away, cementing Rari Chain’s reputation as a dysfunctional platform.

The Gabe Weiss Campaign—Another Misstep:

Following the Rari Chain’s failure, the Gabe Weiss campaign suffered a similarly dismal fate. With almost no user engagement, it had to be prematurely shut down. This pattern of poorly executed initiatives reflects a systemic lack of competence and strategic vision within the team. Funds were once again being ‘‘thrown away’’

Grants Program: Wasting Resources

The 2024 Spirit Grants Program, funded with 50,000 $RARI (~$200,000 at the time), failed to deliver meaningful results:

- OSPN (“Beyond PFPs”):

- Consumed 60% of the grants budget.

- Delivered only 12 videos with an average of 15 views each.

- The last update was over five months ago, yet this grantee has been approved for more funding.

- Mintpad:

- A no-code NFT creation tool that remains underutilized, with no data supporting meaningful adoption.

- DAOSpace:

- A gamified DAO participation tool still incomplete and overshadowed by the team’s broader inefficiency.

Only 20% of the grants budget was utilized, and none of the funded projects have had a tangible impact on the ecosystem. This level of ineffectiveness is unacceptable.We need projects building on Rari Chain. If the team, having more than one year to execute it couldn’t bring builders - it’s a problem.

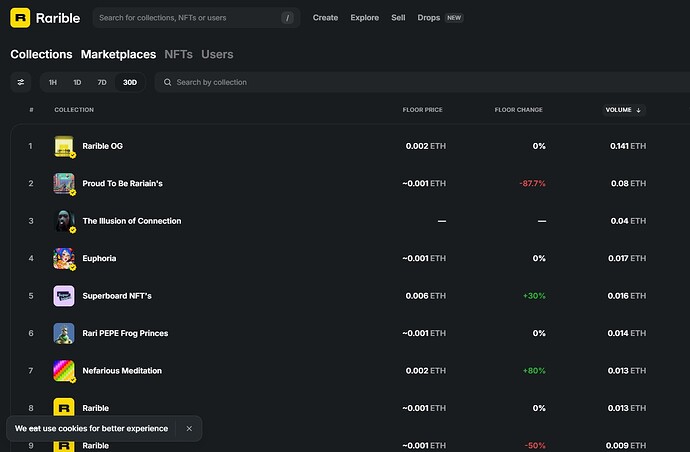

0 connection with parent Rarible marketplace

Nearly everything the Rari DAO pursued in 2024 had little to no impact on Rarible.com, the very platform we should be striving to support and grow. One of the DAO’s primary objectives remains unfulfilled, with no tangible efforts aligning with that goal. The activities and initiatives undertaken are completely disconnected from the Rarible marketplace—a platform that, for most, is logically and directly associated with the $RARI coin. Without a strong Rarible, there can be no strong Rari DAO, and vice versa.Foundation team doesn’t seem to be well connected with Rarible representatives, which is not acceptable.

Absurd Operational Costs and Treasury Drain

The proposed $2.3 million budget includes $1.2 million for salaries, equating to over $10,000 per employee monthly, alongside allowances for travel and a 30% fund reallocation clause. These costs are unjustifiable given the team’s failure to produce measurable results or drive ecosystem growth.

The DAO’s treasury is depleting at an alarming rate without any substantial revenue-generating activities to offset expenditures. Continuously approving million-dollar budgets while watching the treasury dwindle is reckless. It is imperative to reassess how funds are allocated and ensure they contribute to long-term sustainability.

Lack of Commitment from Leadership and Delegates

Another critical issue is the lack of alignment and commitment from those being paid by the DAO. Many of these individuals do not hold $RARI tokens and immediately sell their allocations, signaling a lack of belief in the ecosystem’s future. This behavior undermines trust and raises serious questions about their true intentions and dedication.

This was most evident when Cohort delegates ran out of $RARI and were unable to vote. During that period, the few active voters were genuine $RARI holders. This highlighted the alarming reality: the majority of delegates are not genuinely invested in the DAO’s success.

Cohort Delegate Programs: Misaligned Incentives

Through Cohort Delegate programs, $RARI is allocated to delegates who often show little interest in Rari Chain’s development. Aside from a handful of dedicated individuals, most delegates do not participate in campaigns or ecosystem activities. Instead, resources are funneled into working groups aimed at rewarding delegates themselves—an absurd and self-serving misuse of funds.

Delegates should act as champions of the ecosystem, actively contributing to its growth and governance. Their current disengagement and focus on personal incentives highlight a deeper structural issue.

Lack of Professionalism and Accountability

Despite the significant resources allocated to the Foundation team, there is a concerning lack of professionalism in their operations. For example, during a recent community call—organized by the Foundation—no representatives from the Foundation team were present to lead the discussion. This level of negligence and disregard for their responsibilities is unacceptable, especially given the scale of funding they are requesting. It reflects a broader pattern of complacency and a lack of accountability.

No Progress, No Logic

It defies logic to allocate millions of dollars annually to a team that consistently fails to deliver.On top of that, millions of dollars for ecosystem growth allocated to them. The lack of measurable progress, combined with exorbitant costs, indicates a fundamental problem in how the DAO is managed. As a community, we must confront this reality and work together to implement meaningful reforms. Continuing down this path will only lead to further treasury depletion and diminished credibility.

Recommendations for Reform

- Replace Leadership:

- The current team has proven incapable of fulfilling its responsibilities. New leadership is needed to prioritize results, transparency, and accountability.

- Tie Budgets to KPIs:

- All funding must be tied to clear, measurable key performance indicators (KPIs) such as user adoption, transaction volume, and ecosystem growth. Regular public updates should be mandatory.

- Focus on NFTs:

- Redirect efforts and resources toward NFT-centric initiatives, which are the core value proposition of Rari Chain.

- Performance-Based Compensation:

- Salaries and rewards must be tied to performance. Those who fail to deliver should not be compensated at the same level as high performers.

- Community-Led Decision-Making:

- Empower the community to play a greater role in selecting projects and approving budgets, ensuring alignment with DAO priorities.

- Promote Treasury Sustainability:

- Develop revenue-generating initiatives and adopt financial discipline to ensure the DAO’s long-term viability.

Conclusion

The Rari Foundation’s track record of failure and waste cannot be ignored. Approving another multi-million-dollar budget without significant reforms is unjustifiable. The lack of commitment from paid contributors, the unsustainable treasury model, and the glaring absence of progress demand immediate action. A lack of planning, poor technical implementation, and disregard for community engagement brought us to the current state of watching the Treasury getting drained, speed-running to 0, while DAO generates almost no revenue and we dont have users and builders on Rari Chain.

As a community, we must reject this proposal and work collectively to restructure the Foundation, enforce accountability, and prioritize initiatives that create real value. The future of the DAO depends on it.