Abstract

Axal proposes a strategic integration between its Autopilot yield agents and the RARI Foundation ecosystem. Through Autopilot, the Rari Foundation would be able to create a custom DeFi agent and put a portion of its treasury to work and earn recurring revenue through yield harvesting.

What Axal proposes:

-

To put $RARI as one of its featured tokens on the platform

-

Axal also proposes a unique NFT for early adopters to pay 0 fees while trading. This NFT can be exclusive to Rarible.

-

The Rari Foundation places $50,000 of its treasury in a non-custodial yield agent earning 6-10% to begin; that yield can be transferred to an external wallet for recurring revenue on a monthly basis or compounded.

-

This is totally non custodial, and the trading strategies would be preapproved based on Rari’s interests.

-

The lockup period would be between 6-12 months.

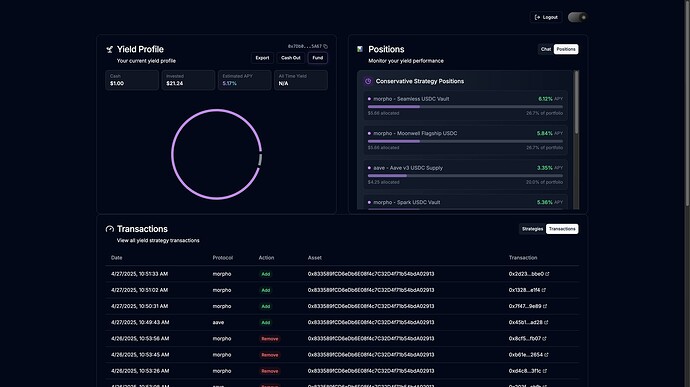

The goal is to deploy a dynamic, risk-adjusted yield strategy across DeFi lending pools. The AI agent actively monitors pool health via metrics such as TVL, TVL volatility, and depegging risk. Based on real-time analytics, Autopilot reallocates capital to safer pools when risks escalate.

Who is Axal

Axal (ax.al, x.com/getaxal) is creating a network of verifiable agents, fulfilling general tasks via intent marketplaces.

Harvard, AWS, SIG trained team, raised $2.5M from a16z CSX, CMT Digital, Escape Velocity, and other top investors

Their first applications, ax.al/autopilot and x.com/gekko_agent, leverage the Axal network to intelligently automate web3 investing. Current partnerships include Coinbase CDP, Movement Labs, Privy, and Virtuals Protocol.

Motivation

For the Rari Foundation, Axal Autopilot provides:

- A chance to brand Rari in the AI/Agents/DeFi space alongside Axal

- Passive yield stream for the Foundation

- Enhanced capital safety (yield is diversified and health is monitored)

- Intelligent liquidity allocation

This proposal represents a long-term value-add to the Rari ecosystem, increasing protocol stickiness, user trust, and treasury diversification/revenue generation.

For Axal, the motivation is to integrate our product with as many Tier 1 foundations as possible/build a relationship with a Tier 1 NFT marketplace.

Rationale

This partnership aligns with Rari Foundation’s commitment to decentralization and sustainability. The monthly harvesting of yield into a foundation wallet creates recurring revenue that allows for sustainable operations. It is all done in a non-custodial manner.

In this partnership, Axal also features $RARI in its flagship index feature and agrees to use Rarible as its exclusive marketplace when launching its NFT program.

Key Terms

TVL – Total Value Locked; a measure of the liquidity in a protocol.

Depegging Risk – The risk that a token loses its pegged value, commonly applied to stablecoins.

Yield Harvesting – Periodic claiming and redirection of earned yield while preserving principal.

AI Agent – An autonomous software that can make decisions based on real-time data.

Autopilot – Axal’s platform for AI-powered yield management agents.

Specifications

Yield Strategy: The Rari Foundation selects its yield strategy (risk/APY target, preferred lending pools and protocols), and yield harvesting schedule.

Yield Harvesting: A cron-based scheduler triggers monthly yield claims, sending earnings to a designated Rari Foundation wallet.

Infrastructure:

- Chain support: Initially Arbitrum, Base, Hyperliquid, and Solana

- Protocols: Aave, Morpho, Pendle, Kittenswap, Kamino, and Meteora

- Alchemy smart wallets for agent delegated actions

Revenue Model: Rari receives 100% of net yield (excluding gas and fees), can withdraw in full after 6 months.

Content Strategy:

We will do a big co-marketing push highlighting Rari and its integration with Autopilot:

- Announcement video (example).

- Co-authored blog.

- Axal team includes former writers at Forbes, Business Insider, and Bitcoin Magazine. We are currently working with UMA and DappRadar on a paper that will be reviewed by top AI agent ecosystems and the EF.

- Happy to have Rari Team member on our podcast.

- Editorial team at Axal runs Talking Intentionally, former guests include: Paolo Ardoino (CEO Tether), Hart Lambur (Founder UMA), Illia Polosukhin (Founder NEAR), Anna George (CoWSwap Founder).

- Twitter/X thread.

- Cross-listing on each other’s ecosystem pages or dashboards…

Promotion:

We can leverage our connections in the media, including friends at Blockworks and Cointelegraph, to potentially talk about the partnership.

We can continually do content around the partnership highlighting how agents can play a big role in the future of the Rari Foundation.

Steps to Implement

- Agent Architecture Finalization – Axal team to lock in thresholds and supported protocols (Week 1)

- Delegated Execution Setup – Integrate with Privy for secure off-chain intent delegation (Week 2)

- Foundation Wallet Integration – Connect yield payout to Rari-controlled multisig (Week 3)

- Launch – Production deployment of AI agent (Week 4)

Timeline

Provide a clear timeline for the project, including start and end dates, milestones, and expected completion dates for each phase.

Example:

- Month 1: Rari deposits $50,000 into Autopilot Yield. Large marketing push around collaboration

- Month 2: Axal designs and pushes out NFT’s exclusive to Rarible

- Month 3: Axal interviews members from Rari team for Axal’s flagship DeFi podcast, Talking Intentionally (former guests include CEO of Tether, Near, and Across)

- Month 4: We run 2 Twitter spaces with the Rari team talking through ideas of how agents can be impactful in DeFi.

- Month 5: Rari and Axal continue co-marketing push about Agents x Rari

- Month 6: Rari can withdraw funds if needed/we reevaluate partnership

Overall Cost

- Total: $50,000 deposit from the Rari Foundation into a non custodial Yield agent on Autopilot. Deposit will earn 6-10% yield, and can be withdrawn after 6 months. Can discuss deeper integration later on if community favors it.